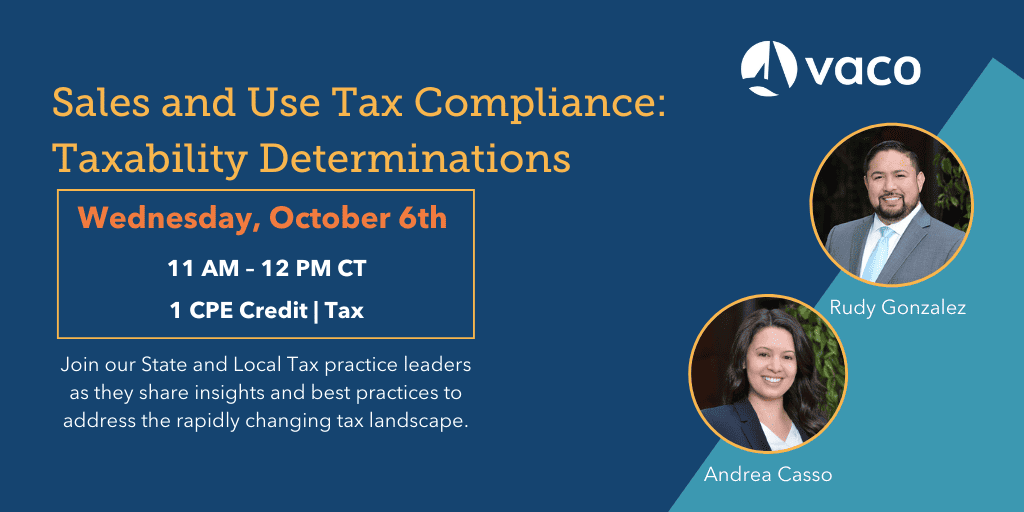

- Webinar Date: October 6, 2021 @ 12:00 PM EDT / 11:00 AM CDT

- Duration: 60 min

The past three years have been focused on Wayfair, now COVID, and all for very good reason. They continue to change the sales and use tax landscape, however, as business’ establish nexus with new states, what does that look like from a compliance perspective?

In this on-demand webinar, we focus on taxability determinations and general compliance within a variety of industries, such as construction, grocers/convenience stores (retail), manufacturing, etc. Our experts provide detailed insight into selected states, demonstrating how states differ in treatment and intricacy. Although a business may not operate within the manufacturing or construction space, it is equally as important to understand the treatment of such services, for the purposes of use tax (purchases of such services for example).

Learning objectives include:

-

Understanding the technical complexities of determining taxability within the various industries, and its organizational impact

-

Obtaining an intermediate understanding of state’s taxability laws

-

Obtaining a general understanding of today’s sales and use tax landscape and what to expect going forward

The CPE portion of this webinar has concluded, but users can still view the presentation recording for educational purposes.